Forex Trading Education: Mastering the Markets

Forex trading can be a complex yet rewarding venture for individuals looking to invest in the foreign exchange market. With the use of proper education and tools, anyone can become proficient in trading currencies. If you are looking to enhance your understanding of Forex, consider visiting forex trading education exglobal.pk, a comprehensive resource for traders of all levels.

What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies in the global marketplace. The forex market is the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. This market operates 24 hours a day, five days a week, offering abundant opportunities for traders to profit from fluctuations in currency pairs.

The Importance of Education in Forex Trading

Education is paramount in Forex trading, as the complexities of the market can easily overwhelm beginners. Understanding trading strategies, market indicators, and risk management is essential for success. Moreover, gaining knowledge about macroeconomic factors that influence currency movements can greatly enhance trading performance.

Key Concepts to Learn

1. Currency Pairs

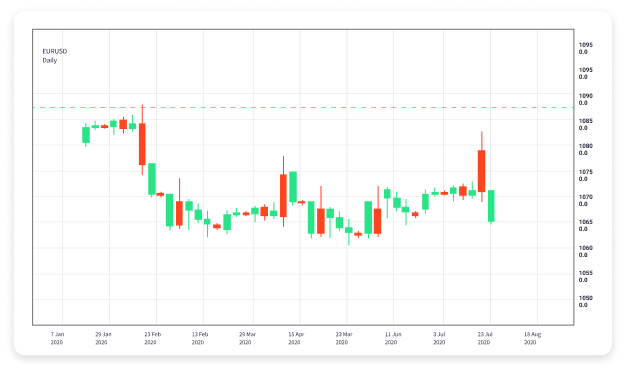

In Forex, currencies are traded in pairs (e.g., EUR/USD, GBP/JPY). The first currency in the pair is the base currency, while the second is the quote currency. Understanding how to analyze and interpret currency pairs is vital for predicting price movements.

2. Pips and Lot Sizes

A pip (percentage in point) is the smallest price movement that a currency pair can make. Understanding pips is crucial, as they determine the profit or loss in a trade. Additionally, traders need to know about lot sizes, which refer to the number of currency units being traded. Standard lot sizes usually consist of 100,000 units, but smaller lot sizes (mini and micro) are also available.

3. Technical and Fundamental Analysis

Two primary approaches to analyzing the Forex market are technical and fundamental analysis. Technical analysis involves using charts and indicators to predict future price movements based on historical data. On the other hand, fundamental analysis focuses on economic indicators, news, and global events that can impact currency values.

4. Risk Management

Risk management is crucial for long-term success in Forex trading. Traders must develop a solid risk management plan, including setting stop-loss and take-profit orders, to protect their capital and maximize profits. Determining the right position size based on risk tolerance is also essential.

Effective Forex Trading Strategies

Becoming a successful Forex trader involves mastering various strategies that align with individual trading styles. Here are some common strategies:

1. Scalping

Scalping is a trading strategy where traders make quick trades, aiming to profit from small price changes. Scalpers often enter and exit positions multiple times within a single trading session.

2. Day Trading

Day trading involves opening and closing positions within the same trading day. Day traders capitalize on short-term price movements, often leveraging technical indicators to make informed decisions.

3. Swing Trading

Swing trading focuses on capturing larger price movements over several days or weeks. Swing traders typically use a combination of technical and fundamental analysis to identify potential entry and exit points.

Utilizing Forex Trading Tools

Various tools can assist traders in their Forex journey. Here are a few essential tools:

1. Trading Platforms

Trading platforms, such as MetaTrader 4 and MetaTrader 5, provide traders with the ability to execute trades, analyze charts, and access market news. Selecting a reliable trading platform is crucial for successful trading.

2. Economic Calendars

An economic calendar is a tool that lists significant economic events and data releases that can impact currency prices. Monitoring these events is crucial for traders looking to anticipate market movements.

3. Technical Analysis Tools

Various indicators and tools can aid in technical analysis, such as moving averages, Fibonacci retracement, and Relative Strength Index (RSI). Familiarizing oneself with these tools can enhance decision-making.

Continuous Learning and Community Support

The Forex market is ever-evolving, requiring traders to stay informed about market trends, new strategies, and economic developments. Continuous learning through courses, webinars, and reading materials can sharpen one’s trading skills. Additionally, joining Forex trading communities or forums can provide valuable insights, support, and camaraderie among traders.

Conclusion

Forex trading can be both thrilling and profitable for those willing to invest the time and effort required to learn the necessary skills. By educating yourself on key concepts, trading strategies, and utilizing available tools, you can enhance your chances of becoming a successful Forex trader. Remember, trading involves risks, and having a comprehensive understanding of the market will equip you to navigate challenges effectively. Begin your trading journey today, and turn your aspirations into achievements in the financial world.